The world is transitioning into a new industrial era, powered by digital technology. But which industries are embracing the future today, and which are trailing in the race to tomorrow? And what does it all mean for the humans?

FNTV’s latest ranking, the FNTV 2025 Digital Industry Index, separates the first movers from the barely moving based on exhaustive quantitative analysis of market and geographic data, as well as qualitative analysis from me, Steve-o.

At the top of the Index, yet at the bottom of the ethical spectrum, are the companies conniving with governments to establish an Orwellian global surveillance society. In the No. 2 position is manufacturing, exemplifying Industry 4.0 with the widespread use of robotics, automation, AI-driven quality control and dense private 5G deployments. Then it’s back to the domain of moral turpitude; the defense industry secures third place by dint of its enthusiastic repurposing of previously benevolent civilian technologies, such as 5G, to make their death-dealing machines more lethal and more profitable.

At the opposite end of the Index are the Luddites of the digital revolution: education, construction and agriculture, which lag behind all others, mainly due to a combination of regulatory and cultural factors.

Three-tier stratification

Pulling back from the individual rankings (see table below), FNTV’s new index reveals a clear three-tier stratification of digital industrial maturity.

- Tier I – Hyper-Digital (Ranks 1–4): These sectors blend AI, autonomy, and secure networks at national or industrial scale. This is AI + 5G + data fusion + automation as a single digital biome.

- Tier II – Infrastructure & Platforms (5–8): Sectors providing energy, connectivity, commerce, and logistics — the operational spine of global digitalization.

- Tier III – Old School (9 – 14): A hodgepodge of industries that aren’t yet on board with the global shift to Industry 4.0 and are characterized by pilot projects and procrastination.

Digital industrialization (also known as Industry 4.0) is shaping the future of the global economy, and the competitiveness of countries, industries, and companies depends on their ability to deploy it effectively, quickly, and at scale.

But what does this mean for the human beings working in these industries - or served by them? That’s both an existential question and a more nuanced one (and one that was not addressed in the Index methodology).

The answer hinges less on technology and more on the business philosophy of the executives overseeing these industries and the governments regulating them.

The key factor that will determine whether Industry 4.0 is merely beneficial for business or also ‘a force for good’ is whether industry players harness AI and automation to eliminate the human workforce altogether, where possible. That’s clearly the default stance of Big Tech (“fewer humans mean more money for us; screw the little people”). Fortunately, this trend is being countered by an encouragingly large number of industries (including telecommunications) and countries (such as Sweden, Finland, and China) that are committed to keeping humans in the loop.

Tier I – Hyper-Digital

These sectors blend AI, autonomy, and secure networks at national or industrial scale.

Tier II – Infrastructure & Platforms

These sector provide energy, connectivity, commerce, and logistics.

Tier III – Old School

These are a hodgepodge of industries that aren’t yet on board with the global shift to Industry 4.0 and are characterized by pilot projects and procrastination.

Methodology

Rankings and insights are based on comprehensive surveys and industry reports and integrate quantitative data from sources such as the International Federation of Robotics, McKinsey, Harvard Business Review and the World Economic Forum.

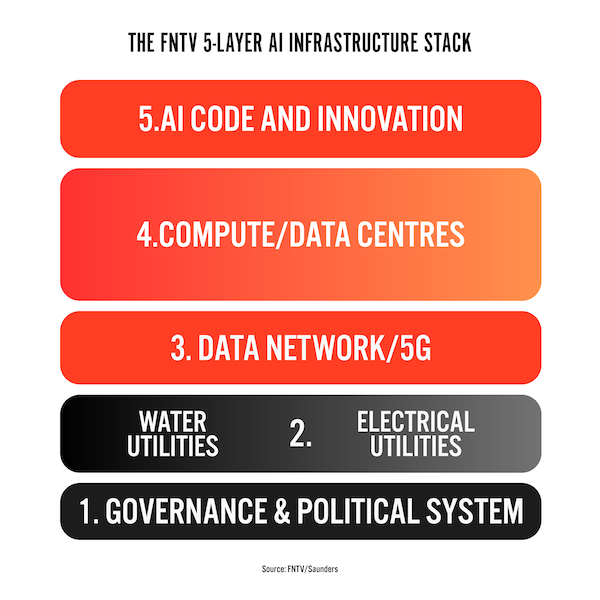

The framework assesses industries based on their adoption levels of AI, private 5G, predictive analytics, automation, and robotics. It adheres to the same precepts as FNTV’s 5-Layer AI Infrastructure Stack, as used in the FNTV Critical Infrastructure for AI Index (CIA Index, 2025 Edition).

The methodology produces a comparative view of digital maturity. Industry-specific case studies and recent deployment data inform the sector profiles and barriers analysis. Rankings were compiled using OpenAI’s Deep Research model and then error-checked and adjusted by Saunders/FNTV, who also provided the qualitative analysis of the results.

Sources

McKinsey & HBR digital index, World Economic Forum, International Federation of Robotics, Stephen M. Saunders’ insights (FNTV/Fierce Network), industry surveys, and reports.

Steve Saunders is a British-born communications analyst, investor and digital media entrepreneur with a career spanning decades.

Op-eds from industry experts, analysts or our editorial staff are opinion pieces that do not represent the opinions of Fierce Network.